A little earlier than expected, Spark’s announces Luxturna pricing, $850k

Spark surprised us with the early announcement of Luxturna’s $850,000 price tag, a week prior to #JPM18 when we expected it.

The company has clearly done their homework and is doing a very good job of leading the gene therapy market in the right direction – kudos to their team.

Below is a summary of what you need to know about the Luxturna clinical story and its market opportunity. We’ve also highlighted some of the questions regarding this highly watched commercial launch.

Click Here to Subscribe to Our Monthly Gene Therapy Business Review

Market Opportunity Observations

Statistical Significance vs Clinical Significance vs Value: Spark has pretty clearly demonstrated the statistical significance of Luxturna. However, the true measure of Luxturna’s commercial success will be driven by the clinically meaningful or practical significance the treatment brings in patients’ lives. Luxturna is not a cure for blindness, but has shown improvement on a unique and practical study endpoint that needs to translate into patients’ lives to create meaningful value. As noted below, the direct and indirect costs of low vision/blindness are surprisingly low at $17-27k per person per year (at least in our opinion). Without trying to make a direct comparison of the seriousness or importance of either condition, the urinary incontinence market provides a good example of the clinical versus statistical issue. One very commercially successful drug showed a statistically significant drop in urge incontinent episodes from 3.7/day to 1.4/day, a 60% reduction. While this was a meaningful difference, patients still required planning and coping strategies to prepare for those remaining 1.4 episodes. The drug cost $2k-$3k/year. For Luxturna, though vision may be partially restored, patients may need to rely upon current means of managing vision loss. How does this continued reliance align with the $850k cost?

Patient Segmentation and Prioritization: Needless to say, the above speaks to the importance of knowing who is likely to benefit and by how much.

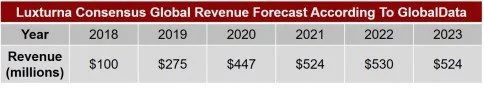

Understanding the Forecast: We’ve provided an external consensus Luxturna forecast below although it is hard to know what the key drivers of Luxturna uptake are: is it the need for real world clinical experience/proven value, is it patient selection, is it payer access, is it innovative over time revenue recognition, is the company managing expectations, or likely a complex mixture of all of the above? It seems a little slow, but to truly grasp this new emerging market for expensive “one and done” therapies we need to understand the Patient Flow Dynamic adapted for the gene therapy market. Gene therapies, properly forecasted, will have very different revenue curves than traditional markets – this forecast looks a little too traditional.

Market Access: Spark’s contracts and payment models may offer a way forward for future gene therapies. How the marketplace reacts (i.e. potentially and ironically delaying treatment) waiting for the CMS decision to their delayed payment proposal remains to be seen.

Efficacy

Spark created and validated its own clinical endpoint: Multi-Luminance Mobility Test (MLMT). MLMT assesses participants’ ability to navigate a course at seven different levels of illumination. It encompasses aspects of visual field, visual acuity, light perception and contrast sensitivity. The MLMT is a grid of arrows which a participant must follow, stepping over and around obstacles to reach a door at the end.

Luxturna Phase 3 clinical study results showed a statistically significant difference between the intervention group (n=21) and control participants (n=10) at one year in mean bilateral MLMT score change although it does appear to have some variability in response based on the confidence interval (mean difference of 1.6; 95% CI, 0.72, 2.41), but it is a small sample. 93 percent (27 of 29) of all treated Phase 3 trial participants saw a gain of functional vision as assessed by bilateral MLMT. Furthermore, the mean MLMT improvement was sustained at 3 years (1.8 lux levels at three years, compared to 1.9 lux levels at one year).

No serious adverse events (SAEs) associated with Luxturna or deleterious immune responses have been observed. Two ocular SAEs were reported in the clinical program: one in Phase 1 (the treatment for bacterial endophthalmitis led to elevated intraocular pressure and subsequent optic atrophy) and one in Phase 3 where the SAE was related to the surgical procedure and resulted in foveal thinning and a sustained reduction in visual acuity (VA) in one participant.

Market Opportunity

Worldwide prevalence is 6,000 individuals with biallelic RPE65 mutations (1,000-2,000 people in the U.S.), although not all patients are candidates for Luxturna.

Assuming no price inflation and full $850k price, the cumulative global sales are $2.4 billion and represent 2,800+ treated patients. More realistically, these forecasts probably assume treatment of 3,000-4,000 patients with rebates and discounts around the world.

Contracting and Access

At launch, Spark is offering two contracting alternatives:

An outcomes-based rebate arrangement with a long-term durability measure: Spark Therapeutics will share risk by paying rebates if patient outcomes fail to meet specified thresholds for both short-term efficacy (30-90 days) and longer-term durability (30 months) measures.

An innovative contracting mode under which the payer or payer’s specialty pharmacy will purchase Luxturna, agree to provide coverage for its members consistent with the product label, expedite benefits processing and cap patient out-of-pocket amounts at in-network limits.

Spark Therapeutics is seeking additional solutions to allow customers to pay for LUXTURNA in installments over several years. Currently, government price reporting requirements make such solutions infeasible. Offering outcomes-based rebates above a certain threshold may also provide government price hurdles. Spark CEO Jeffrey D. Marrazzo has said, “We are committed to finding a novel solution to providing an installment payment option to payers” and are “eager to work with CMS to enable more meaningful rebates as part of the pay-for-performance model.”

Interesting HEOR Fact

According to a 2013 evaluation of the Economic Burden of Vision Loss completed by NORC at the University of Chicago, the direct and indirect costs of low vision is $15,900 per person with vision loss. It turns out to be very difficult to allocate costs between those who are blind versus those with impairment, but the study conservatively estimated that low vision costs are $26,900 per year for each person blind.

Another great resource to delve into the HEOR and other market dynamics can be found in the draft ICER report released in November 2017 (link to document below).

RxC International will continue to monitor the market implications of Luxturna’s price as well as other gene therapies as they are approved.

Connect with Us at #JPM18

RxC International will be at the JP Morgan conference and surrounding events. To schedule 20 minutes discussing gene therapy commercialization and access issues, contact us here.

References

About RxC International

Understanding the subtleties of the gene therapies is critical for bringing these treatments to market. RxC International has extensive experience successfully commercializing and launching new drug products, developing innovative solutions, realizing a product's best potential, and working across organizations to achieve common goals.

Visit our Gene Therapy Resource Center to sign up for our monthly newsletter or to explore other posts and resources on launching and commercializing gene therapies